Corporate Filings And Market Magnetism

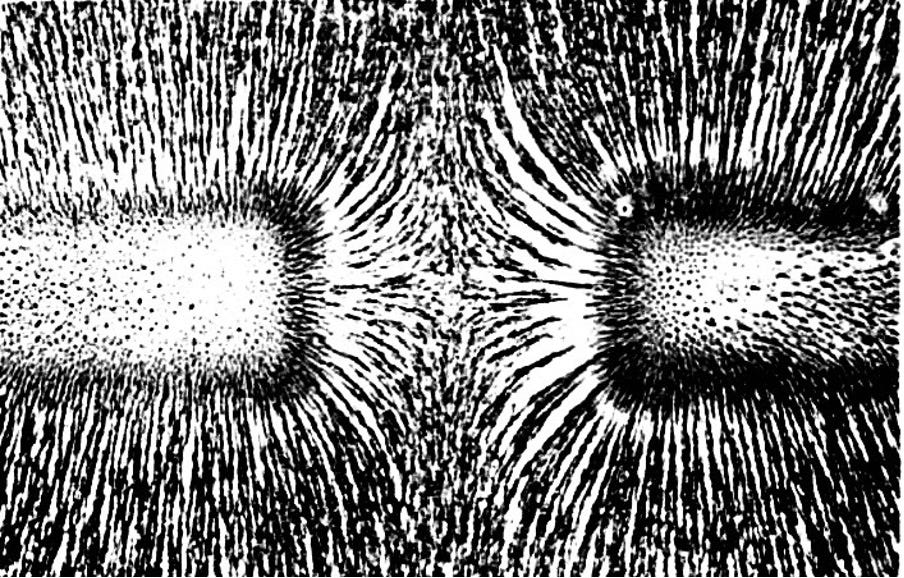

Our current focus on companies is like focusing on individual iron filings—rather than on the magnetic fields that shape them into patterns.

Most of us probably recall the school physics experiment where a magnet was moved around beneath a sheet of paper sprinkled with iron filings. We saw the scattered filings stand to attention and the zoom into striking geometrical patterns.

And the patterns changed every time the magnet was moved.

As I have worked on this Rewilding Markets series of posts, it has become ever-clearer that today’s companies, and other businesses, tend to behave in precisely the same way in response to actual—and perceived—market dynamics.

Think of Meta’s Mark Zuckerberg abandoning third-party fact-checking for Facebook and Instagram. Zuckerberg is signalling that he is an iron filing. And, in the process, he is turning a blind eye to what has happened to X, formerly known as Twitter.

With X increasingly operating like a cesspit, many of us are trying to step around it and find ways to migrate to BlueSky and other alternative platforms.

Hand over Greenland—or I’ll thump/Trump you!

Meanwhile, however, the rot is spreading. And, as the Trump-Musk axis of chaos is already signalling, business leaders now face several years of vaulting back and forth to fit in with the political and ideological equivalents of the magnetic fields we saw at school.

Though multiple magnets are suddenly in play—and they are in the hands of people who are losing their grasp on longer term reality. Witness the incoming Trump Administration’s threat to dismantle key elements of America’s climate-facing institutions, while Los Angeles burns.

The political discourse is degenerating into something very much like schoolyard bullying, with the brawniest thugs throwing their weight around and demanding that their playmates hand over the playground equivalents of Greenland or the Panama Canal.

Political magnets going rogue

As companies like Ford, Mercedes-Benz, Unilever and Volvo back away from publicly declared climate commitments, it is increasingly clear that they do not see market incentives aligning any time soon with broader stakeholder priorities.

Fine, that’s their view and they are, in effect, casting their votes. But they are going to find it increasingly dizzying to keep up with the latest whims of today’s rogue bar magnets. Working on internet time, they will change their minds and priorities so fast that they scramble normal governance processes.

What they don’t yet understand is that what they are effectively doing is inviting the rest of us to refocus our attention and efforts from the filings to the forcefields, from today’s companies to tomorrow’s markets.

That is what Volans began to do with its Tomorrow’s Capitalism Inquiry—and it is what I am continuing to think through in this series of posts. I would genuinely appreciate any feedback, either through the comments channel here, or via email at john@volans.com.

John Elkington is Founder & Chief Pollinator at Volans. His personal website can be accessed here. His latest book is Tickling Sharks: How We Sold Business on Sustainability (Fast Company Press, 2024).

Available on Amazon and through good bookshops.

What readers say:

“John has seen farther, sooner, and better than anyone how commerce could reimagine the world and has done so with modesty, eloquence, and kindness.”

PAUL HAWKEN, environmentalist, entrepreneur, author of The Ecology of Commerce, Drawdown, and Regeneration

As always, you're right on the money John (excuse the pun).

It really does feel as though we're on the brink - and we've chosen to be here.

Have we left it too late? Many people like Jem Bendell etc believe so and are working hard to adapt to climate collapse.

Out of curiosity, I 'googled': "do we have to wait for the economic system to break and witness social and environmental collapse, or do we still have enough people and time to do something about it?

I'm not sure if this is the right question, however the AI generated response was this:

"No, we don't have to wait for the economic system to break to do something about climate change and social and environmental collapse:

1. Take action on climate change

Some say that action on climate change should be the starting point, and that economic growth can be compatible with that objective.

2. Reform the financial system

Some say that the global financial system needs to be reformed to provide more funding for vulnerable countries and to restructure debt.

3. Create a popular movement

Some say that a popular movement based in academia and civil society can help guide humanity towards developing a new "foresight intelligence".

4. Support new initiatives

Some say that there is growing government support for moving beyond GDP and growth at all costs towards new wellbeing indicators and greater wealth distribution.

5. Recognize that a strong economy and a healthy environment are complementary

Some say that there is growing evidence that a strong economy and a healthy environment are not only complementary, but each depends on the other.

6. Some say that the biggest challenge in avoiding collapse is convincing people, especially politicians and economists, to alter their behavior. "

How many represent 'some' as in "some say" ?

It feels like a minority, but as always the likes of Musk, Trump, Zuckerberg, Farage et al have the loudest voices, so I'm not sure how many 'some' are. Perhaps there are enough?

My question is how do people like you, organisations like Volans, Donut Economics, Wellbeing Economy Alliance (WEAll), Global Commons Alliance, Planetary Healthcheck, B Lab, Social Enterprise, the All Party Parliamentary Group on Limits to Growth, and the many, many more individuals and organisations who are committed to shaping a better world better communicate and collaborate? Huge apologies for that ridiculously long sentence.

Every piece of data I encounter leaves me feeling more concerned, and less hopeful. I really want and need that to change.

When we talk about markets, we must include consumers in the equation. Not just focusing on companies but also integrating consumers as co-creators of the economy and the type of development we aim to build. One of the essential questions we need to live with, paraphrasing Otto Scharmer, is: How can we rebalance the economic playing field so that consumers can engage in collaborative, conscious consumption and become equal partners in creating well-being for all?

We need to place greater emphasis on consumers. We are the most powerful market incentive.